8.4 Government Insurance Health Programs

Presently, most patients ages 65 and over have some form of Medicare, while many low-income patients and families of any age have state-funded Medicaid coverage.

Up until 1965, over 50% of citizens over the age of 65 years had no health insurance at all! Through the Social Security Amendments of 1965, Medicare and Medicaid were approved, providing government-assisted health insurance coverage for seniors, people with disabilities, and the financially vulnerable. (However, there was no prescription coverage for seniors until the Medicare Modernization Act in 2006.) Medicare programs are administered by the federal government, whereas Medicaid programs are administered by state governments. The Children’s Health Insurance Program (CHIP) was established in 1997 through the Balanced Budget Act of 1997. The ACA established the Affordable Care insurance exchanges in 2014. These are both administered by individual states.

Medicare

In 2018, over 59 million persons were enrolled in one or more Medicare programs. Once a patient is 65 years old, he or she is eligible for the Medicare programs. Other Medicare participants include those with a chronic kidney disease or those who have received Social Security disability insurance (SSDI) for 24 months. Because of the debilitating nature of the disease, patients with ALS (amyotrophic lateral sclerosis, or Lou Gehrig’s disease) are able to receive coverage from the first month of their Social Security disability coverage.

Medicare became the first federally funded health insurance program when President Lyndon B. Johnson signed it into law on July 30, 1965.

If a person becomes eligible for Medicare while still working, it is recommended by most health insurance consultants that they elect to continue current employer coverage too, because the Medicare programs cover only a portion of incurred medical costs. The employer may in part subsidize the monthly insurance premiums of enrolled employees or retirees. However, there is no penalty for delaying Medicare benefits—a patient may wish to remain insured through the employer plan if the insurance is comprehensive and affordable so that there is no need for a secondary insurance.

Pharm Fact

Pharm Fact

The Medicare Parts Open Enrollment Period goes from mid-October to the first week in December each year.

Medicare funding is drawn from a monthly premium automatically deducted from the patient’s monthly Social Security check during retirement. One’s Social Security account has the accumulated amount from payroll deductions during one’s working years. If the patient is not yet receiving Social Security, they must pay a quarterly or monthly premium to the Center for Medicare and Medicaid Services (CMS).

Four different Medicare programs provide various types and levels of healthcare insurance, and it is important for the pharmacy technician to know the basics of each plan (Parts A, B, D, and comprehensive C), as only some cover some prescription drug costs or pharmacist services. Medicare can often be used when patients are away from home and seek medical attention out of their home state.

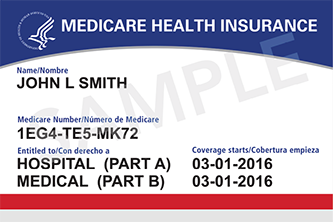

The familiar red, white, and blue Medicare coverage card covers only Medicare Parts A and B. The insurance cards for Medicare Parts D and C are similar to commercial insurance plans, as they are through contracted providers and PBMs.

Medicare Part A

Medicare Part A typically covers 80% of the cost of hospital stays as well as limited coverage of skilled nursing and physical rehabilitation facilities, and home health care. (A community pharmacy cannot bill for any drugs or services under Medicare Part A.) Any person who reaches age 65 and submits an application automatically qualifies for this health coverage. The monthly premiums are the same for all participants, regardless of income or assets.

Medicare Part B

Medicare Part B is designed to go with Part A and covers 80% of the cost of doctor visits to diagnose and treat an illness after a low deductible is met. Again, the monthly premiums are the same for all participants, regardless of income or assets. (The 2019 monthly premium was $135.50 with a $185 deductible). It does not cover any prescriptions either, but it does fully cover some preventive medicine, such as vaccines and screening tests. If these services are provided through a pharmacy, the technician will ask for the red, white, and blue card for insurance processing.

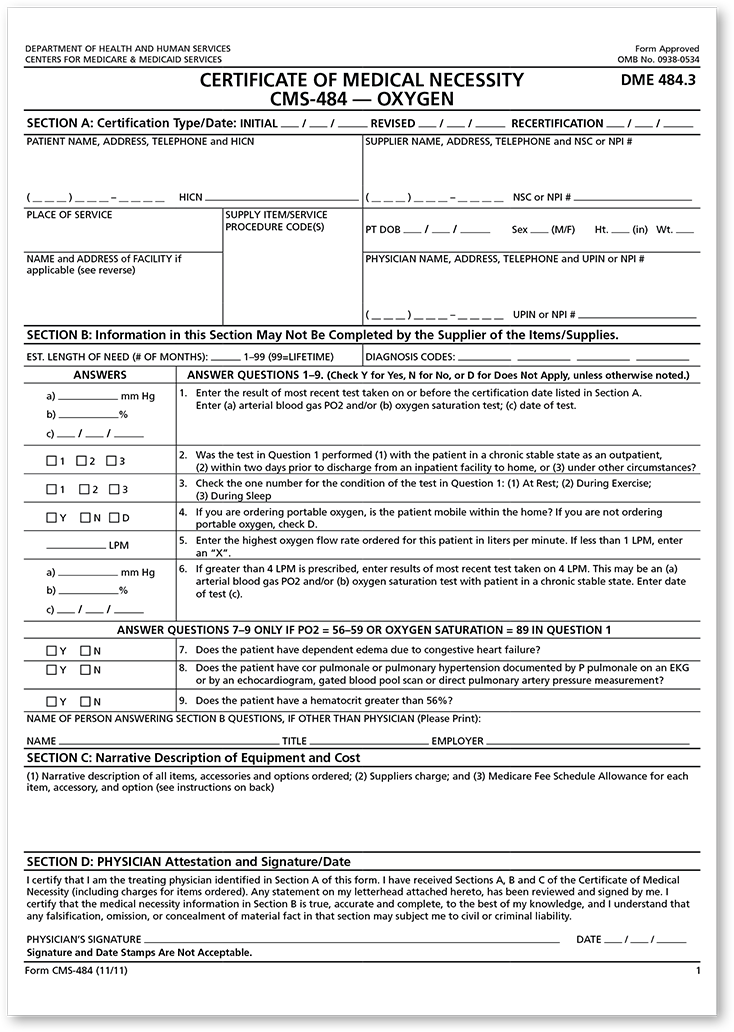

This Medicare program may also cover a portion of the costs of some medical devices, known as durable medical equipment (DME), when these are deemed “medically necessary” by the healthcare provider. For some DMEs, a certificate of medical necessity (CMN) form must be completed online or on paper with an ICD-10 diagnosis code, and it must be signed by the patient and the pharmacist (see Figure 8.2). If the community pharmacy has been awarded a contract with the Center for Medicare and Medicaid Services as a provider of DME, it may bill for equipment (such as wheelchairs and hospital beds) and services directly to Medicare Part B.

Pharm Fact

Pharm Fact

Though Medicare Parts A and B don’t generally cover drugs, Part B will cover the total cost of the administration of the annual flu vaccine and the pneumonia vaccine every five years.

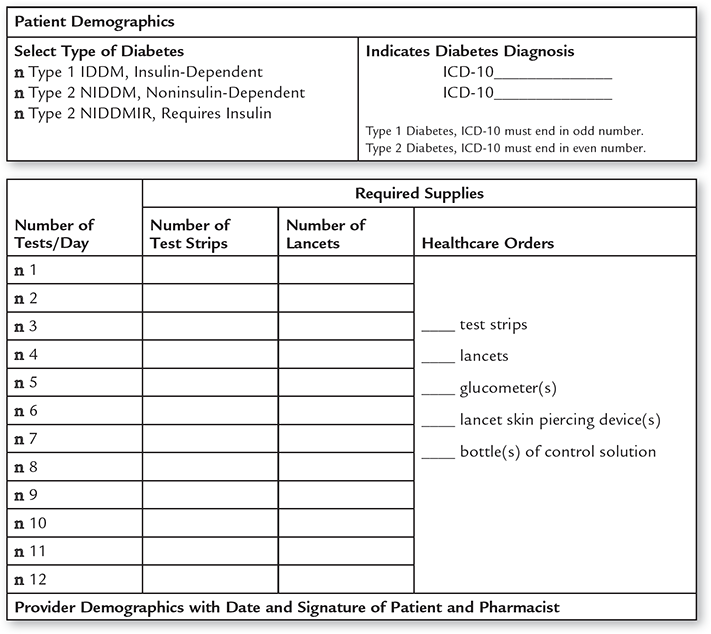

In addition, some disposable medical supplies may be covered by Medicare Part B, but these do not require a CMN form to be completed—though they do require other documentation of medical necessity by the prescriber, such as a Written Order/Prescription Prior to Delivery (WOPD). Included are diabetes supplies such as syringes, needles, pen needles, lancets, blood glucose monitors, and test strips. The prescription must include the correct ICD-10 diagnostic code for diabetes and the necessary frequency of daily insulin injections and blood glucose testing (see Figure 8.3).

Medicare Part B also requires a prescription for coverage of a nebulizer and solutions, with a new nebulizer allowed and required every five years. To fill a nebulizer solution prescription, such as for albuterol, the pharmacy must have documentation that a nebulizer has been purchased within the past five years. In addition, Medicare cannot be billed until the patient (or patient’s guardian) personally picks up the diabetes supplies or nebulizer and/or solution. Other drug insurance plans often cover the nebulizer solutions but not the nebulizer machine itself.

Practice Tip

Practice Tip

Medicare Part B will cover some disposable and durable medical equipment, but technicians must have the proper documentation to file claims.

To be reimbursed for medication therapy management services, the pharmacist must be contracted for them by a Medicare-approved health center or clinic. The billing would then be submitted to Medicare via the contracting center, which would then pay the community pharmacy.

Medigap Insurance Plans

Since Medicare Parts A and B cover only some medical services, some patients also opt to purchase a supplemental Medigap insurance plan from a private health insurance provider (such as Blue Cross/Blue Shield) to cover the additional costs of outpatient physician visits as well as laboratory and x-ray costs, vision, hearing, and dental products and services. Medigap policies also typically do not cover the cost of any prescription drugs.

Medicare Part D

As has been established, Part A, Part B, and Medigap insurance plans do not cover prescription drugs. However, the Medicare Prescription Drug, Improvement, and Modernization Act (MMA) of 2003 established the option of Medicare Part D—a prescription drug insurance targeted at helping patients pay for medication costs. Enrollees can add this program to their existing Medicare A/B health coverage with an additional monthly charge to their current Medicare premium. Medicare Part D contracts with insurance companies or PBMs to offer approved prescription drug plans (PDPs). Patients can choose from several drug insurance plans that are available in each region, designated by zip code.

Figure 8.2 Certificate of Medical Necessity for Oxygen

This is a sample of a DME form that must be filled out by the provider to allow for some insurance reimbursement.

Medicare Part D is complex with many choices. Each contracted plan has its own advantages and disadvantages. Though a government program, it is funded in part by patient premiums and administered by private insurers such as Blue Cross/Blue Shield, Aetna, Humana, and United Health, or by PBMs such as Express Scripts International. Premium costs can vary widely, from approximately $20 per month to over $100 per month, depending on the deductible. In addition, there may be copayments with each prescription.

Figure 8.3 Form Used to Bill for Diabetes Supplies to Medicare Part B

Prescribed diabetes supplies will be covered by Medicare Part B if the physician writes the correct ICD-10 coding and the pharmacy technician completes the proper form with signatures from the pharmacist and the patient.

Practice Tip

Practice Tip

Technicians can remind customers nearing age 65 that they are eligible for Medicare Part D and inform them of the benefits. They can find more information online at the Medicare website, which can be accessed at https://PharmPractice7e.ParadigmEducation.com/MedicareD.

Medicare Part D has special provisions for low-income seniors and provides catastrophic coverage for all patients who develop serious medical conditions requiring expensive drug treatments. Information on the Medicare Part D insurance cards of eligible low-income members dictates their lower copayment costs. Almost 40 million patients who are eligible for Medicare have taken advantage of signing up for a Medicare Part D insurance program. If patients opt not to enroll when eligible at age 65, the monthly cost may be higher by the time they decide to join. Individuals must renew their enrollment annually during the open enrollment period (late October through the first week in December).

Every patient who enrolls in Medicare Part D can expect to save an average of 25% to 30% annually from the actual consumer costs of prescriptions. However, in some plans, a deductible of approximately $400 on prescription costs must be paid before patients are eligible for initial coverage benefits. After the deductible is met, patients pay an average of 25% of the cost for their new and refilled prescriptions (generic and brand names) for the first $2,960 of total drug costs (from both out-of-pocket and insurance).

Medicare Part C (Comprehensive)

If Medicare patients don’t want three or more insurance plans to get full coverage, there is Medicare Advantage, or Medicare Part C. This program offers the full package of hospital, doctor visits, and prescription drug insurance. Like Part D, Medicare Advantage is administered by various private commercial insurance companies contracted by Medicare. They come in all kinds, such as HMOs, PPOs, fee-for-service plans, special needs plans (SNPs), and Medicare Medical Savings Account Plans. That is why Medicare C is complex and often confusing.

Approximately 30% of all Medicare-eligible patients opt for a Medicare Advantage program. If the community pharmacy has a contract with a Medicare Part C insurer, there may be coverage for DME equipment such as hospital beds, wheelchairs, walkers, and other supplies including nebulizers and blood pressure monitors, depending on the plan. Vision, hearing, and dental services are not typically covered by Medicare. However, some Medicare Advantage plans may offer some coverage. Some Medicare Advantage programs may restrict the choice of doctors, specialists, or hospitals, or charge additional costs for out-of-network doctors or hospitals.

Medicaid

Medicaid is a healthcare insurance program run jointly by the federal and state governments. Medicaid subsidizes the cost of health care, including drugs, for eligible disabled, low-income, part-time, and unemployable state citizens of any age. (Some disabled older adults are “dual eligible” for both Medicare and Medicaid.) Each state designs its own state plan that has different eligibility requirements and benefits. There is no monthly premium, but patients may be charged an additional copay when they pick up their prescription(s). Pharmacy technicians should know their own state policies, procedures, and regulations on the reimbursement of prescription drugs for eligible Medicaid patients. Medicaid does not cover prescriptions that are filled in a state other than the state in which the patient resides. It also does not cover prescriptions from providers who are not in the state plan’s network.

Practice Tip

Practice Tip

When filling Medicaid prescriptions, check that the patient’s card is from in-state. If not, let patients know that Medicaid will not cover their prescriptions. Out-of-state travelers and tourists may not realize this.

Eligibility is based on income and number of dependents, and it is frequently reviewed by the state. Patients may be covered by insurance with their employer but still need Medicaid to fill the gaps. To help all citizens get insured, the ACA provides financial incentives for states to extend their Medicaid eligibilities to cover more uninsured patients, so the eligibility ranges have expanded and they are variable according to state legislative decisions.

IN THE REAL WORLD

IN THE REAL WORLD

Medicare is prohibited from using its huge negotiating power (over 50 million members) with pharmaceutical manufacturers to lower drug costs on brand name and specialty drugs. This is one of the reasons why drugs are so much cheaper in many other countries, such as Canada. An amendment to this law would need to be approved in the future to control future drug price increases.

Children’s Health Insurance Program

Like Medicaid, the Children’s Health Insurance Program (CHIP) is a low-cost- to-free healthcare insurance program run jointly by the states and the federal government aimed at uninsured children from ages 0 to 19 whose parents (including pregnant women) earn over the federal poverty line but too little to cover healthcare insurance for their children. Most state CHIP plans do not have a deductible, but they do charge monthly premiums and copays.

Affordable Care Insurance Exchanges

Many people are not covered by either government-sponsored or employer insurance. Many small employers (fewer than 50 employees) have elected not to provide health insurance coverage as an employee benefit because it is too expensive. Their workers have to purchase health insurance on their own. Self-employed contractors and entrepreneurs also have to find insurance on their own. In addition, employees working part-time (less than 30 hours per week) or who are unemployed also need to find insurance.

To assist these individuals and families, the ACA established online affordable healthcare exchanges so that eligible individuals and families can comparison shop online for plans within their price range. These plans are lower cost than the regular market plans because of group discounts as well as governmental subsidies in many cases. This is a system of shared coverage among Medicaid, Children’s Health Insurance Programs, and affordable care eligibility programs. Some of these exchanges are state run, some are federally run, and some are run in partnership. Each insurance plan must meet standards of financial accessibility for patients in order to offer the program through the exchanges.

Individuals or families pay a monthly premium on a sliding scale based on their income. Depending on how individual or family income compares to federal poverty levels, individuals and families can qualify for a subsidy or a discount on their monthly insurance premium. Of the citizens who qualify for government subsidies, 85% pay less than $100 per month.

Pharm Fact

Pharm Fact

Recent polls by the Centers for Disease Control and Prevention indicate that the number of uninsured people in the United States has continued to decrease from 14% in 2013 to 8.8% in 2018.

IN THE REAL WORLD

IN THE REAL WORLD

Back in 2013, 15% of US citizens, or 41.3 million people, were uninsured, with little affordable access to health care. About two-thirds of uninsured individuals had one person in the family working, but that employment situation offered no healthcare. Since the passage of the ACA, great progress in coverage has been made. In the first full year of implementation in 2014, 15.7 million previously uninsured persons received healthcare coverage either through healthcare exchanges or expansion of the state Medicaid programs. The rate of uninsured children decreased from 13.9% in 1997 to 4.6% in 2015.

However, 14 states in 2018 still had not expanded Medicaid eligibility or found ways to cover those in the zone of federal poverty level, and 8.8% of all Americans, or 28 million citizens (a large portion of whom are children), remain uninsured, according to the United States Census Bureau (September 2018). For an independent analysis on the effects of the ACA on the uninsured, visit the Kaiser Family Foundation website at https://PharmPractice7e.ParadigmEducation.com/KFF.

There are generally four plans available—bronze, silver, gold, and platinum—going from least expensive and least comprehensive to most. The bronze plan usually has a high deductible. After it is met, the bronze plan covers 60% of healthcare costs. The silver plan typically covers 70%, and the gold plan 80%. The platinum plan that covers 90% has the highest monthly premium. For young, healthy patients, the bronze or silver plan is recommended due to its lower cost. Most insurance buyers (75%) favor the silver plan. All of the programs have a cap on the total annual out-of-pocket costs through in-network providers for an individual (approximately $6,500 in 2015) and for a family ($13,200). The programs, premiums, and coverage limits are annually renewable and adjustable. The enrollment period for healthcare exchanges is from November 1st through January 30th each year.

To offer lower patient costs for prescriptions, the various insurance providers in the healthcare exchanges and their PBMs negotiate reimbursement rates in contracts with pharmacies. Technicians need to understand that not all community pharmacies have contracts with all the insurers in their state’s healthcare exchange due to low reimbursements. If your pharmacy does not have a contract with the PBM of the patient’s ACA insurance provider, then you will not be able to process the prescription claim and must let the patient know this prior to filling the prescription.

Military Health Insurance

The Defense Health Agency (DHA) administers Tricare, which is the four-part federal health and prescription drug insurance plan for active and retired members of the military and their families. For active duty members, their military photo IDs or military dependent IDs double as proof of insurance. Retirees and their family members generally pay a higher premium than active duty members.

In 2018, Tricare Select replaced Tricare Standard and Extra.

Practice Tip

Practice Tip

Mail-order prescriptions can result in some delivery delays. If a prescription is needed before the mail-order arrival, the pharmacy with the prescription on file may call the provider and the PBM for an insurance overide to provide a small supply to bridge the time gap.

The patients who come to community pharmacies generally have Tricare Select or Tricare for Life. Prescription copays or coinsurance payments may differ, depending on the patient’s active or inactive status in the military. As with other insurance programs, the payment fees and the coinsurance proportions for prescription drugs have been increased—with little or no notice to military patients, their families, or retirees. Pharmacy technicians often have to explain why patients’ copayments unexpectedly increased at the time of dispensing.

The VA has its own outpatient and inpatient pharmacies at hospital centers where many pharmacy technicians work. To avoid lines and save money, the VA encourages its members to use one of its seven highly automated mail-order pharmacies. Over 316,000 veterans receive a package of prescriptions in the mail every day. Convenience is the main reason that most members utilize the VA’s mail-order service.

Tricare Prime

Tricare Prime is a military service HMO, with assigned primary care physicians and in-network providers. It is the most cost-effective program, but a person needs to live near a military base and/or Veterans Health Administration (VHA) hospital and clinics to receive the generous coverage of hospital admissions, medical visits, and services with relatively low copays for prescribed drugs. There is an annual enrollment fee if the enrollee is not on active duty and small fees per visit, service, or product.

Pharm Fact

Pharm Fact

The seven VA mail-order pharmacies process almost 460,000 prescriptions per day—nearly 80% of all outpatient prescriptions.

Tricare Select

Tricare Select offers the most choices, with open selection of providers and pharmacies, and it costs the most. It has an annual deductible and a coinsurance payment for what Tricare says the medical service or product should cost.