8.6 Processing Prescription Drug Claims

To work successfully in any community or mail-order pharmacy, technicians need to process drug claims on the spot with great efficiency—while the patient is watching and waiting. You will face all kinds of situations: new patients with new insurance, established patients with expired insurance, drug discount cards, workers’ comp claims, patients with no insurance, and patients with multiple insurances. All the information must be accurately entered into the pharmacy’s computer software to process the drug claim.

The pharmacy technician has to enter both the insurance information and the prescription into the computer for processing the claim and filling the prescription.

Pharmacy software differs, but, in almost all cases, billing involves direct online transactions between the pharmacy and the customer’s insurance PBM. The procedures to bill online PBMs for commercial insurance, federal or state governments’ plans, or workers’ comp are similar but not identical. Learning the ins and outs of various insurance plans as well as their interfacing with the pharmacy’s software package is a challenging task.

Technicians must be trained in the specific processes and procedures for each pharmacy and PBM to avoid insurance-claim problems. Pharmacies can receive stiff financial and civil penalties from the PBM for intentional or unintentional billing errors caught in a PBM audit. If the PBM challenges an incorrectly processed claim, the pharmacy can lose both the cost of the drug and any dispensing fee.

IN THE REAL WORLD

IN THE REAL WORLD

An estimated 3.2 million Americans are infected with hepatitis C. The specialty drug sofosbuvir (Sovaldi) is 90% effective in treating and preventing complications. A typical regimen for a 12-week course of therapy is $84,000. The average cost of such a prescription—without insurance—is over $16,000. A similar drug, ledipasvir (Harvoni), costs over $1,000 per tablet. Even with insurance, a 25%–33% coinsurance is beyond the means of most patients. Technicians can then direct the patient to try to qualify for assistance directly from the drug manufacturer to help defray the high copayment costs.

One patient remarked, “I just found out that I have hepatitis C and have had it for years, so the doctor told me I needed a particular drug. It was so expensive I couldn’t possibly pay for it! The technician saved my life by telling me how to sign up for a special program from the manufacturer. I can’t thank her enough.”

Receiving and Entering Insurance Information in the Computer

To begin the process, you need to ask for the customer’s insurance card to input the information into the computer (or double-check it with existing customers). The card usually includes the following information:

name of the primary insured person (or name of family member with their person code)

insurance carrier

nine-digit patient identification number (ID)

group number and/or employer

bank identification number (BIN), designating the pharmacy benefit manager

processor control number (PCN), designating the kind of plan and processing flow

the date coverage became effective

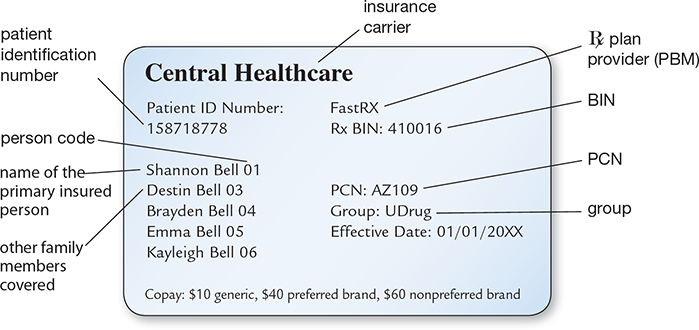

Additionally, some cards will show which family members are covered and the amount of copay for generic and brand name prescriptions. See Figure 8.4 for an example of how this information may be displayed on the insurance card. The BIN and PCN are needed to identify the PBM.

Practice Tip

Practice Tip

Helping patients sort out their insurance cards and understand their copayments or coinsurance and formularies are elements of great customer service.

If the customer is not new, you must ask if any information has changed. If the information on the card (name of cardholder, patient identification number, etc.) is still current, make sure that the card hasn’t expired. If the cardholder’s employment status has changed recently, then the drug insurance on the profile will likely have changed. A patient may be dual eligible, having more than one insurer. If so, the information on both cards must be entered, designating which is the primary and which is the secondary insurer.

Collecting and entering insurance information can be a challenging task. First, the information is not standardized or always accurate. At times, the pharmacy technician may have to call the insurer to verify eligibility.

Some patients, such as those with Medicare Parts C or D and many commercial insurers, have unique medical/drug insurance cards apart from their regular medical insurance or their primary and secondary coverage. They may not know which is which. The patient’s relationship to the cardholder (spouse, child) is represented by the person code, which is required for processing the online claim of a dependent.

You will have to be patient and spend time with customers who are confused or overwhelmed. They may have insurance cards for medical but not pharmacy claims or insurance cards for other members of the family but be missing their own.

Keep in mind that the claim must be successfully processed before the drug is released to the patient, and the patient often expects to receive their prescription(s) within 15–20 minutes or less. Consider all the time it takes to enter the insurance information into the computer, verify the PBM, enter the prescription, process the claim, fill the prescription, and have it checked by the pharmacist. Patience and efficiency have to work hand in hand!

Figure 8.4 Parts of an Insurance Identification Card

In this example, the mother is the primary insurance holder for her four children, the insurer is Central Healthcare, and the employer is UDrug. Not all insurance cards list each person covered, as this example does. Some insurance companies issue cards for each person insured.

Verifying the Pharmacy Benefit Manager

Once the patient insurance profile is complete, you will use the BIN and PCN to identify the correct pharmacy benefit manager (PBM) and the internal processing code for this patient’s plan. (Some insurance cards do not list a PCN, making the technician’s job a little more difficult.) As insurance and Medicaid-funded programs may switch PBMs within the calendar year without patient notice or issuance of a new insurance card, PBM information must be identified and updated with each patient visit.

Practice Tip

Practice Tip

It is a good idea to ask patients to offer their insurance information and any coupons when they drop off their prescriptions rather than waiting until the pickup. This helps reduce the waiting time for them later.

Since there are hundreds of healthcare plans with the same PBM, the group number is also needed to process the claim. The BIN, PCN, and group number designate the specific plan for the specific patient or family. Entering the combination of ID, BIN, PCN, and group number/employer pulls up the proper PBM for verification to establish eligibility to process the claim.

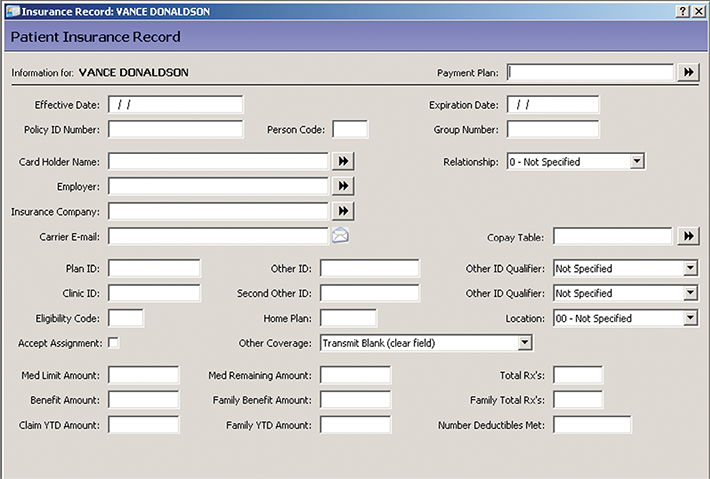

With patients who have dual eligibility, the primary insurance is always billed first online. The remaining amount or copayment may be covered by the secondary insurance. Drug coupons are processed like insurance and applied before the primary insurer is billed to reduce the price, with all pertinent information also entered into the patient database (see Figure 8.5).

Figure 8.5 Insurance Plan Database

An important responsibility of the technician is to update the prescription drug insurance information in the pharmacy database.

Pharmacy Benefit Manager’s Prescription Processing

When entering and submitting prescriptions into the pharmacy software for the drug utilization review (DUR), technicians do not know off the top of their heads (nor do pharmacists and prescribers) which drugs are in the formulary of a specific PBM and which are not. PBM formulary selections are constantly changing, often without notice (with very few exceptions, OTC drugs are not covered). So the software or the technician also transmits the prescription online to the PBM to complete the crucial insurance adjudication step.

Practice Tip

Practice Tip

Though DUR alerts regarding drug interactions, allergies, and other safety issues should not be handled or acknowledged by the technician, DUR notices dealing with DME diagnosis codes, some formulary issues (such as NDC not covered) or days’ supply concerns can in many cases be handled by the technician.

Online Adjudication

Online adjudication refers to the process of electronically submitting prescription claims to the appropriate PBM for its judgment on whether or not it will provide reimbursement. It usually takes less than 30 seconds to receive a reply.

The best-case scenario is when the PBM approves the prescription right away—vthen the technician will be immediately notified onscreen of the patient’s required copayment or coinsurance. You then inform the patient of the cost if it is an expensive copay to make sure that he or she is prepared to pay it. If the patient is surprised and unready, there are options. If the drug is already a generic but expensive, the pharmacist should be alerted to discuss with the prescriber less costly alternatives if available.

The PBM online response also states the proportion of pharmacy reimbursement amount compared to the AWP. Occasionally, the PBM will reimburse the pharmacy less than the AWP. In that case, you need to alert the pharmacist or supervisor, as it is likely that the pharmacy will not be able to fill that prescription.

Many insurance price printouts, which accompany the medication for dispensing, list the amount the patient saved through insurance coverage. It is a good service practice to highlight this amount to customers so that even if the amount they paid is higher than they like, they can walk away feeling a little better about their purchases, knowing that you and the community pharmacy care that they are receiving medication savings.

Practice Tip

Practice Tip

Always let the customer know if a generic drug is cheaper to pay out of pocket than the insurance copay.

In some cases, the cost for a generic drug without insurance is cheaper than the insurance copay. For instance, a patient copay was $10 for all generic drugs. However, the AWP of the prescribed generic anti-nausea drug promethazine was so low that the patient could purchase the generic drug without insurance for only $7.50. The technician made the customer aware of this so that the patient could save money and the time involved in the online insurance adjudication process by just paying out of pocket.

The patient may have multiple prescriptions that need to be processed for pick-up at one time. This will obviously complicate the adjudication process, as each drug needs to be adjudicated separately, perhaps with both a primary and secondary insurer, which requires a coordination of benefits (COB), which will be described later in the chapter. In workers’ compensation claims, COB is almost always needed.

Medications Not Covered by Insurance

A common message for any brand or high-cost medication is NDC Not Covered. When this message or Not an Option appears on the screen in adjudication, it means that this particular drug with its National Drug Code is not covered by the PBM formulary. You can then present the following options to the patient: (1) pay the out-of-pocket costs if not too exorbitant; (2) keep the prescription on file for a later date; (3) the patient can call the prescriber and request a less costly alternative if available; or (4) have the pharmacist discuss the situation with the patient and call the prescriber with recommendations for alternative options or prior authorization if that is needed.

Practice Tip

Practice Tip

For a high-cost drug, remind patients to check online or in local papers for manufacturers’ coupons (or do it for them) or enroll in the pharmacy’s prescription savings plan if it is an often used medication.

Cases exist in which the medication selected by the physician is not covered by the insurance under any circumstances—not even with a prior approval! This lack of coverage often applies to new innovative drugs that are extremely expensive; drugs that promote weight loss or sleep; certain medications for anxiety or nervous disorders; certain cough syrups for adults; and drugs that have less costly alternatives or that are available as OTC drugs.

If such questions about coverage arise, then use the appropriate (toll-free) insurance contact phone number. If the insurer denies coverage, the patient has the right to appeal. This is not done by the technician or pharmacist but by the patient. However, you or the pharmacist must break this news to the patient. Most patients are unaware of this right, and they also need to know that the process requires the completion of a lot of paperwork and is exceedingly slow. In most cases, the patient pays cash or uses a discount card if eligible.

Other rejection messages can appear, and you will get to know them fairly quickly. They are often accompanied by a “reject code.” Claims get rejected for many reasons, including problems with missing or mistyped information, wrong dosages, or special medications requiring prior authorization (PA). Each rejection message will require its own response action to resolve the problem.

Practice Tip

Practice Tip

Resolving insurance claims may be time-consuming for a technician, but it fosters patient trust and customer loyalty, which is often the difference between surviving and not surviving for a small independent pharmacy.

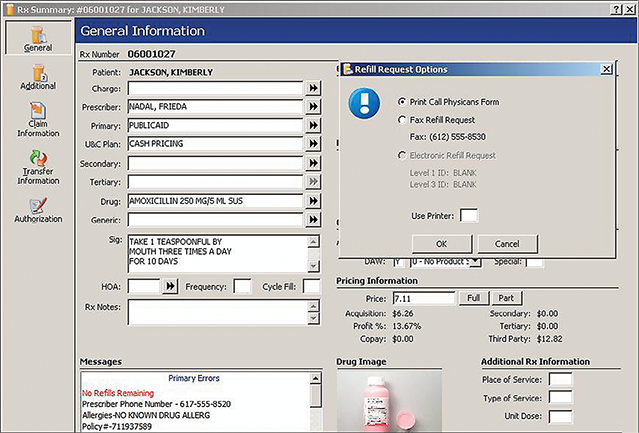

In this situation, Kimberly Jackson’s prescription for amoxicillin 250 mg from Dr. Nadal was turned down for a refill as the number of refills had run out. The pharmacy software popped up the action window noting that a call to the physician was needed.

Catching and Fixing Processing Errors

The goal is to have a safe and accurate prescription and capture the claim, or achieve reimbursement confirmation from the PBM. Yet many things can go wrong in filing a prescription claim, which results in claim denial or no reimbursement. Was an error made in entering the multiple insurance card numbers? Is the patient (or a family member) not eligible? Is the drug prescribed not covered, or does it require special authorization? Does the patient not have any insurance? An experienced technician will be able to resolve most of these questions in real time, as the patient is often waiting in the pharmacy or parked in the drive-through, watching the technician.

Practice Tip

Practice Tip

It is often important to explain to customers that their copayments and drug coverage are determined by the insurance plan, not by the pharmacy.

If a claim cannot be processed because of any unresolved issues, you can try calling the toll-free number on the back of the patient’s insurance card for assistance to clear up the issue. Clearly, much can go wrong when a technician is processing a drug claim, and persistence is a plus.

IN THE REAL WORLD

IN THE REAL WORLD

For 2019, the PBM Express Scripts International (ESI) will cover only Humulin (not Novolin) and Humalog (not NovoLog). CVS Caremark will cover just the opposite on their preferred drug formulary. Even though these drugs are “therapeutic equivalents,” the pharmacist or technician needs to get approval from the prescriber to process the right insulin that fits both the patient and the insurer’s PBM!

As a technician, you will need to be on the lookout for and know how to resolve the most common insurance problems described below.

ID Number Issues If the PBM cannot find a record of the patient, take another look at the ID numbers. Many plans may use letters preceding the ID number, e.g., XYZ1199A2883. Some insurance plans require the letters, but some do not. Letters in the middle of the ID number are usually required. If the error message still pops up, make sure that the customer did not accidentally give you an out-of-date card.

To make matters more complicated, the group number on the prescription card may be incorrect because it has changed, or it may be missing (some plans like Humana do not require a group number), and it will take time to track down the right number and enter it. The correct numbers are then added into the patient insurance profile for future processing. You may want to advise the cardholder to add the correct number in marker to the insurance card.

Name Discrepancies Watch for discrepancies between the name on the patient’s insurance card and the name in the insurance database. For example, Rick Smith may be in the insurance database under his legal name Charles R. Smith, and if you try to process a drug claim under Rick Smith, it will be denied with the error message Unmatched Recipient.

Birth Date Discrepancies If the pharmacy and the insurance company have differing information due to typos or mistakes, the error message Check Birth Date will pop up. Even if the pharmacy has the correct birth date but this does not match the PBM database, the claim will not be approved. To process the claim, call the PBM, verify the listed date of birth (DOB), and enter the incorrect date in the patient profile. The patient (or parent) must then call the insurance company (PBM) to correct the DOB in its system and then advise the pharmacy on his or her next visit to update the birth date correctly in the patient profile.

Practice Tip

Practice Tip

Be aware that you may enter all the patient information correctly (such as date of birth, gender, address, relationship to cardholder), but the PBM may have it listed wrong in its system because of a typo or input error. You (or the patient) will need to call the PBM to resolve the issue.

Person Code Discrepancies Some insurance plans (or pharmacy software) require a two-digit or three-digit person code to follow the ID number. For example, a husband may be there to pick up a prescription, but his wife is the primary insured person under her employee plan. His wife might have the 11-digit ID number 119922883-01 (or 001), whereas he would have the same first nine numbers but the person code of 02 (or 002) as the spouse. The numbers for their dependent children would end with 03 (003), 04 (004), 05 (005), and so on, generally in their birth order. (Most Medicare Part D and Medicaid programs have a patient-specific ID number, so there is no need for an additional person code.) Always double-check that the right person code was entered.

Prescribers’ NPI Issues The correct National Provider Identifier (NPI) number is required for the prescriptions from each physician, physician’s assistant, nurse practitioner, dentist, and pharmacist to be legitimate and processed. (Nurse practitioners or physician’s assistants may use the NPI number of their supervising physician with approval.) These NPI numbers must always be carefully checked to ensure that they match up with the prescriber’s name. In the case of controlled medication, the prescriber must also have a DEA (Drug Enforcement Agency) number on file in order for the claim to be processed and billed.

Out-of-Network Prescriber In rare cases, the claim can even be rejected because the prescriber is not contracted with the patient’s insurance plan (as with Medicaid). This may happen with any new prescriber or with hospital prescribers whose practice is limited to inpatients. In that case, another prescriber or supervising physician in the network must be contacted by phone, and that prescriber must agree to put his or her name on the prescription (except for controlled substances) to process the claim. If the pharmacist or pharmacy technician can identify no alternative prescriber, the patient must pay cash for the prescriptions.

Practice Tip

Practice Tip

If a prescriber’s NPI number is not on file with that patient’s insurance provider, the online claim will be rejected.

Drug Interactions and Combination Rejections There are also the DUR rejections where the PBM software compares the prescriptions with the patient’s medication profile. The review may find that the patient is receiving more than one similar medication, such as two antibiotics at the same time, or it could be that the drug may interfere with another prescribed drug (a drug interaction) or produce an allergic reaction. In these cases, the technician must alert the pharmacist to carefully review the rejection. The pharmacist may choose to override the rejection with the computer software. If not, the PBM and/or prescriber must be notified.

Drugs Requiring Prior Authorization Some prescribed drugs require prior authorization (PA), or prior approval. This can be because the drug is atypical for the patient’s age, gender, or condition; because the drug is not on the PBM formulary; because the patient is already prescribed a similar drug; or the continued use of a drug exceeds the medication’s short-term use recommendations. The pharmacist or technician is then responsible for electronically sending, telephoning, or faxing a PA request to the prescriber’s office. The physician’s representative will then contact the PBM to determine whether coverage can be approved (and for how long) or whether an alternative drug must be prescribed. Basically, both the doctor’s office and the patient’s insurance PBM must review the necessity of approving the prescribed drug versus a lower-cost alternative.

Practice Tip

Practice Tip

PA rejections are very confusing to patients, especially if they previously recieved a drug without a PA. You will need to explain that the PBM wants to communicate with the prescriber to get more information about the ongoing need for a prescription.

For example, if a patient’s cholesterol cannot be controlled with lovastatin (a generic cholesterol drug) and the patient has suffered an adverse reaction to Crestor (the preferred brand cholesterol drug), the PBM would, in most cases, approve coverage for Livalo, providing Livalo with a copay more comparable to the Crestor than its usual copay.

A pharmacy technician should alert the prescriber’s office if the PBM requires a prior authorization to resolve the insurance claim rejection.

In another example, rabeprozal (Aciphex) is prescribed for heartburn but not covered by insurance. The prescriber may elect to change the order to the generic omeprazole or pantoprazole rather than take the time to pursue PA. In this scenario, it is best that the pharmacist speak with the prescriber and counsel the patient about the best drug for the best outcome.

PA often takes 72 hours or longer to resolve, so technicians have to gently ask the customer to return later and explain why. The time needed depends on the efficiency of the doctor’s office and the PBM. If other less costly medications have been unsuccessfully attempted, the drug will most likely be approved (for a limited duration of up to a year). Commonly, the PBM or the physician’s office will notify the pharmacy when the PA goes through. You can then call the patient and proceed again with online adjudication and prescription filling.

Pharm Fact

Pharm Fact

Since prior approvals can take days to process, the prescriber may have a back-up prescription option to use instead, or the patient may opt to pay cash, if affordable.

If the PA is denied, the patient can decide to pay cash for the prescribed drug or request that an alternative drug be prescribed. The patient, technician, and prescriber are put into a difficult position if the PA is for a lifesaving drug, such as one of the newer innovative drugs for hepatitis, and the decision is delayed. Pending legislation in some states would allow the pharmacist to act on behalf of the prescriber and the patient in resolving PAs. This is another example of the expansion of the clinical role of the pharmacist into patient care.

Refill Too Soon Refills with most insurers can be processed within five to seven days of the end date of the current medication (based on days’ supply), but some plans are more restrictive. Then you may get the Refill Too Soon message. You can then tell the patient the exact date the insurance claim can be processed—oftentimes it is only a day or two later from when the patient comes in.

If a refill involves a controlled substance, then the pharmacy’s policy may not allow early refills even if insurance does. To monitor overuse and abuse, many pharmacies will not refill any Schedule III–V controlled substances until the prescription is within one to two days of the current prescriptions’ completion date. For a 30-day supply of medication, the refill would be available 28 to 29 days later, per store policy.

Practice Tip

Practice Tip

It is helpful to keep a notebook to write down tips (especially on anything you had to look up, to avoid doing so again), shortcuts, and notes on the various insurance plans and PBMs.

Incorrect Days’ Supply A rejection may also be due to an incorrect amount for days’ supply—the amount of medication required to last for the duration of the prescription. If you make a mistake in calculating or inputting the days’ supply, or if the PBM only permits a limited portion at a time, the claim will be rejected. For instance, the prescription may be for a 90-day supply of atorvastatin but only 30 days are covered by insurance. So you can adjust the medication history in the patient profile to note 30-day supply with two refills and have the patient come in every month to pick up the 30-day supply. How to calculate days’ supply will be addressed later in the chapter.

Practice Tip

Practice Tip

Patience and empathy are definitely skills needed, as customers get more and more impatient, frustrated, confused, and sometimes desperate with the complex insurance adjudication process and high cost of medications.

Coordination of Benefits

When you have a patient with multiple insurance plans, adjudicate the claim to the primary insurer first, and if the primary insurer does not cover the claim or a deductible or copay exists, then adjudicate the remaining amount to the secondary insurer. (There may still be an amount left to be paid by the patient.) This filing with different insurance companies is called a coordination of benefits (COB).

Here is how it works. Say the disabled patient has primary coverage from Medicare Part D and secondary coverage from Medicaid. Medicare Part D will not cover the anti-anxiety drug alprazolam (Xanax) or any of its alternatives. So you would process the claim to Medicaid as the secondary insurer and any other drugs to Medicare Part D.

COB also occurs when a patient presents a coupon from the medical office for a prescription. The coupon generally covers part or all of the copayment from the primary insurance. If the patient has no drug insurance, the coupon will reduce the cost by a set amount. In nearly all cases, the coupon is for an expensive brand name medication.

Practice Tip

Practice Tip

To seek prior approval for a prescribed drug for a workers’ comp case, the technician would call the caseworker or adjuster instead of a PBM.

For an authorized illness or injury, a workers’ comp carrier is generally entered as the primary insurer (assuming that the patient has other drug insurance coverage). The coverage of the injury typically ranges from 3 to 12 months, based on the injury’s extent and severity. Drug coverage is usually limited to the specific drug classes appropriate for that injury. For example, if back pain is the primary symptom, analgesic and back spasm medications would likely be covered, but antibiotics for a sinus infection would not. For approved drugs, the patient pays no copay.

To electronically process a workers’ comp insurance claim, you must ask for additional information to enter into the patient profile. Besides the BIN, PCN, and group number, you will need the Social Security number, date of injury, and name of compensating business. The initial data entry may take additional time because it generally requires a telephone call to a caseworker or adjuster to obtain or verify the information and drug coverage. The pharmacy may have a contract with more than one workers’ comp PBM, each with its own team of caseworkers and adjusters.

IN THE REAL WORLD

IN THE REAL WORLD

Recently, a pharmacy technician received a prescription for topiramate 150 mg daily. The drug was available in 50 mg and 100 mg capsules. The technician entered 90 of the 50 mg capsules (total daily dose of 3 mg per day) for a 30-day supply—yet the PBM rejected the claim due to exceeding the number of dosage units per day.

With the patient’s permission, the technician reentered 30 of the 50 mg capsules on one prescription and 30 of the 100 mg capsules on another prescription for a total daily dose of 150 mg. The PBM then accepted these claims as they fit the PBM’s supply parameters. Without the quick thinking of the technician, there would be a delay in the patient receiving this drug to prevent migraine headaches. However, this is not always an acceptable solution since it can result in two copays for the patient.

Adding to the complication, the patient may have multiple claims to process at the same time—some drugs must be billed to worker’s compensation while other selected drugs must be sent to the patient’s normal primary insurer’s PBM and, if there is unpaid cost, to the patient’s original secondary insurance.